Trade credit plays a critical role in modern supply chains, fostering smoother cash flows and stronger business relationships. Unfortunately, credit fraud is a serious issue affecting the efficiency of the supply chain market and hampering growth. While financial institutions employ advanced AI-based techniques for fraud detection, trade credit presents unique challenges, such as the need for rapid decision-making, incomplete application data, and business imperatives for credit approvals.

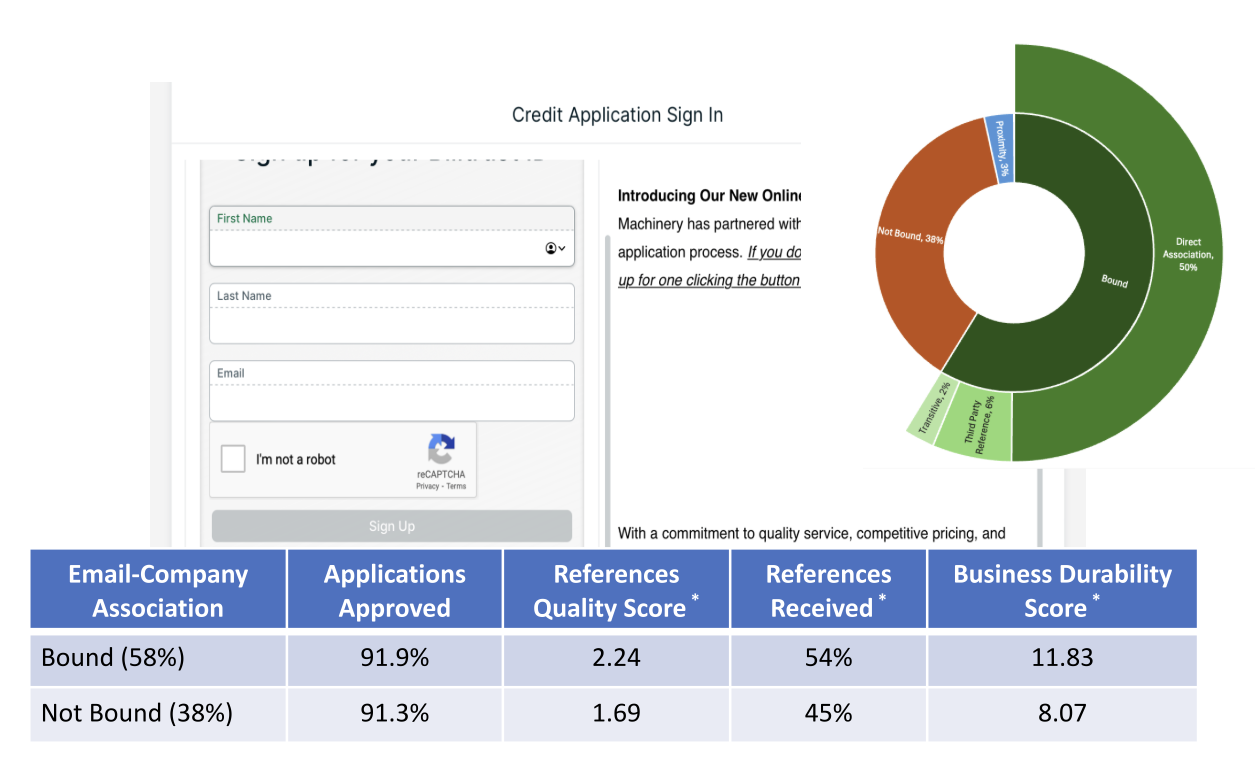

We introduce a practical approach to fraud detection in trade credit applications, leveraging readily available internet-based resources to stratify applications by their likelihood of fraud. Our analysis shows that even when machine learning techniques are not feasible, these methods effectively – by 58% among the over 19K applications studied – narrow the pool of potentially fraudulent applications, allowing suppliers to focus on high-risk cases. Over time, adopting such strategies can reduce business costs, enhance fraud detection, and lay the groundwork for future AI-driven solutions by building valuable labeled datasets.

Discover more in our white paper on Tackling Trade Credit Fraud.